G.1 HoTARAC PPP accounting guidance

In 2004, the Heads of Treasuries Accounting and Reporting Advisory Committee ("HoTARAC") developed and issued specific guidance for government bodies, based on a predominant economic ownership model, using seven risk and reward categories.

The HoTARAC guidance was adapted from the UK FRS 5 Application Note F - Private Finance Initiative and Similar Contracts. Prior to the establishment of an Australian Standard, agencies should generally refer to the AASB Framework and the risks and rewards test under AASB 117 Leases as described in Section 9.2.2. As the HoTARAC guidance does not have the same authority as the AASB Framework or AASB Standards, this should be referred to for guidance only.

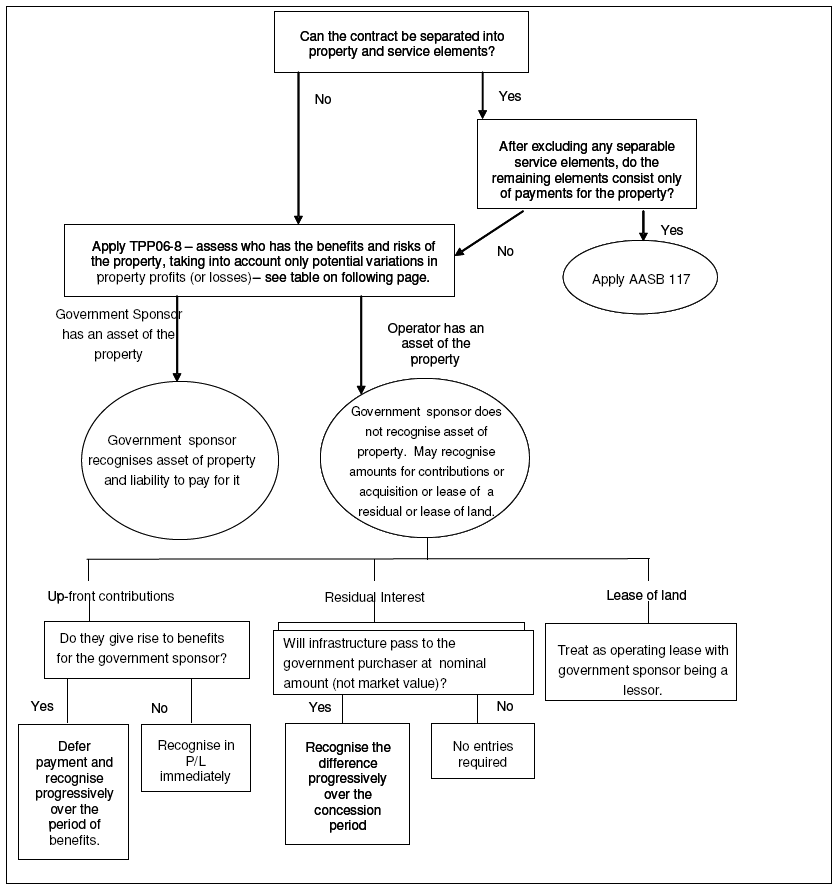

The HoTARAC guidance states that where a PPP contract can be separated into elements that operate independently of each other, and where some of those elements relate only to services separate from the property asset, any such service elements are excluded from the analysis as they are not relevant to determining which party has the asset.

Once any separable service elements have been excluded, PPPs can be classed into those where the only remaining elements are payments for the property and those where the remaining elements include some services. Where the only remaining elements are payments by the grantor for the property asset, the PPP should be accounted for as a lease in accordance with AASB 117 Leases. Where the remaining elements include some payments for services, the PPP should be accounted for in accordance with this guidance.

The guidance states that the question of which party should recognise the property as its asset should be determined by considering which party has most of the risks and benefits in relation to the property. The guidance identifies the principal factors that might be relevant to an arrangement such as demand risk, third-party revenues, who determines the nature of the property, penalties for under-performance and non-availability, potential changes in relevant costs, obsolescence and residual value risk.

Where the grantor has an asset and a liability to pay for it, these should be recognised in its balance sheet.

Where the grantor does not have an asset of the property, other assets or liabilities may require recognition. These can relate to up-front contributions, the residual interest in the property, and associated leases of land.

In relation to up-front contributions, the policy states that the accounting treatment depends on whether the contributions give rise to future benefits for the grantor. If they do, they should be deferred and recognised in the income statement progressively over the period of the benefits. If they do not, they should be recognised immediately.

In relation to the residual interest in the property, the guidance states that the accounting treatment depends on the amount at which the property will transfer to the grantor at the end of the PPP. Where the contract specifies the amount (including zero) at which the property will be transferred to the grantor at the end of the contract, any difference between that amount and the expected fair value of the residual, estimated at the start of the contract, should be recognised progressively over the term of the contract.

Conversely, where all or part of the property will pass to the grantor at the end of the contract on payment of its then market value, no accounting is required until the date of transfer as this represents future capital expenditure for the grantor.

The following chart summarizes the decision route for the application of HoTARAC guidance: