2.7 Use of CAPM to calculate project Discount Rates

It is important to note that CAPM is applied in its modified form for the derivation of the Discount Rates for the assessment of the PSC versus the PPP. As with other theoretical frameworks, CAPM is a means by which observable market based data can be translated into surrogates for determining future rate of return requirements.

Introduction to CAPM

The following provides an introduction to the theory of CAPM.

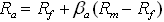

An investor expects to receive a return that is equivalent to the Risk-free Rate plus the proportion of systematic (or market) risk that is being taken on by a project. In its simplest form, the CAPM provides a direct estimate of the required return for a project (asset). That is:

• Ra is the required return on assets whose risk class is designated by the Beta or Systematic Risk (in the Methodology this is called the Project Rate)

• Rf is the Risk-free Rate

• βa is the Asset Beta, which reflects the degree that asset returns (ie, returns of a particular project) are expected to vary with returns of the market (ie, a well Diversified Portfolio of assets or projects)

• (Rm- Rf) is the return over the Risk-free Rate (the market risk premium or equity risk premium) that investors would need or expect in order to invest in an asset

It is important to have a sound understanding of the components that make up the Discount Rate and other key project specific issues that may impact on the rate used in certain circumstances.

Risk Free Rate (Rf )

The Risk-free Rate is the return on capital that investors demand on riskless investments (that is, those that produce a constant return regardless of what is happening in the economy), and the accepted estimate for this is the long term Public Sector Bond rate.

In developing the discount rate under this guidance the Commonwealth Bond rate should not be used to calculate the discount rate for either the PSC, or the PPP. A nominal risk free cost of debt should be used, referenced to the marginal cost of debt in the particular jurisdiction. This rate should then be adjusted for any Systematic Risk transferred (See Section 5).

Beta Factor (βa)

Beta is a measure of relative risk. A project with a Beta of more than 1 is more risky than the market as a whole and a project with a Beta of less than 1 is less risky. The Beta factor is the expected covariance of returns from a project with the returns of the market as a whole, divided by the variance of returns of the market. (Covariance measures how much the project return and the market return move together).

The risk associated with a project is reflected in the variability or, uncertainty of the cash flows. Therefore, because assets determine the nature of the cash flows and their associated risks, it is the assets that ultimately determine the Discount Rate.

There are two types of Betas used in financial applications, Asset Beta and Equity Beta. Which of these is appropriate depends on the context. The Methodology uses Beta to refer to an Asset Beta, not an Equity Beta. That is, it is a measure of the market risk of all the cash flows of an asset or project, irrespective of the capital structure or gearing.

To find a project or Asset Beta, it is necessary to turn to the best available proxy rate observable in the market for companies whose core business is similar to the project being analysed. The assumption made is that the observable rate incorporates those risks normally retained by such companies in undertaking projects of the type being considered and for which the market is prepared to pay a premium to invest.

Practitioners should be aware that the observable Beta of a company available on common databases is an Equity Beta. These Betas are not suitable for use in the Methodology as they reflect a company's financial leverage, or gearing which will cause the Equity Beta to differ from its Asset Beta. For the Methodology it will be necessary to remove the financial leverage (risk) so as to isolate the specific asset risk and identify the required premium for the type of asset being considered.

In considering PPP projects the Public Sector is not paying a premium to the Private Sector for the risks associated with the financial gearing of the structure. The process of degearing (or deleveraging) an Equity Beta to arrive at an asset (ungeared) Beta is outside the scope of this document, but for an outline of the process and a discussion on the differences between Asset and Equity Betas practitioners should refer to Brealey and Myers Chapter 9 or Lonergan Chapter 6.

Practitioners should seek professional advice to assist in the identification of appropriate Asset Betas to inform the calculation of specific Project Rates where this is deemed necessary.

Market Risk Premium

The market risk premium (Rm - Rf) represents the "extra" return over the Risk-free Rate that investors require to invest in the market as a whole. For the purpose of examples, the rate used in the Methodology for market risk premium is 6 per cent2.

In applying CAPM to PPP projects, the calculation of Discount Rates using the CAPM framework from first principles can be a time consuming task, which may not be warranted given that the result is an approximation. It is not the intention of the Methodology that CAPM be applied in precise detail but its application should be adapted to suit the size, strategic importance and complexity of each project. The focus of the Methodology is on identifying the rate appropriate to the specific situation, while accommodating the cost/benefit trade-off of performing more data collection (such as a specific Beta) and performing detailed calculations.

The Methodology requires that in the first instance, a more generic approach be taken using pre-determined categorisation of projects based on comparable risk profiles. Benchmark CAPM data is provided in Section 3 to use in these circumstances. Practitioners should use sensitivity analysis to determine whether the results of their evaluation could be altered by small to medium shifts in the Discount Rate (say +/- 0.5% and 1.0% on the Discount Rate). If so, practitioners should consider determining a more precise Discount Rate from first principles.

______________________________________________________________________________________________

2 MRP is based on generally accepted market practice. The more recent regulatory reviews conducted by the ACCC and government based regulators have adopted a MRP in the range of 6-7%