Group 1 Services

The Services included here are those Services which will not be benchmarked and for which the Project Company is assumed to use its own staff- i.e. a Labour Services Agreement will not apply to the staff providing these services.

A major identified value driver for PPP procurement is whole-of-life costing. These associated costs and other non benchmarked costs will not be adjusted for during the Project Term apart from the CPI assumption made through the financial model.

It is argued that the CPI adjustment encompasses the requisite increases in these non benchmarked costs due to inflation, but it is highly likely that the weighting of the goods and services that make up the CPI number may be different to the cost weighting in the Project. For example, Maintenance and Refurbishment Services represent 20 per cent of the overall operating costs on an NPC basis. A large proportion of these costs are labour related. The change in average weekly earnings over the 12 months to December 2003 was 3.6 per cent, which was higher than the change in CPI. This is consistent with the historic trend of wages inflation being greater than CPI per review of wage rate changes from Access Economics6.

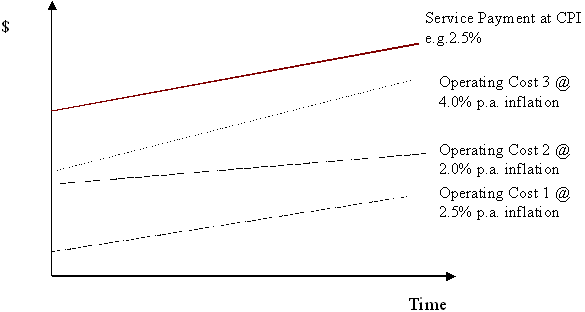

The diagram below illustrates the potential build up of costs by the private sector in formulating the Service Payment:

The build up of costs that underpin the Service Payment may not necessarily correlate with the CPI rate of, say, 2.5 per cent per annum In the above example, it is estimated that Operating Cost 1 and 2 will be compensated for by CPI, but CPI does not cover Operating Cost 3 which is inflating at 4% per annum (i.e. CPI + 1.5%). It is deemed likely that the private sector will price in the estimated 4% per annum in the Service Payment, but this is only a forecast. The private sector will also price in a premium to account for the Systematic Risk that actual real price increases will differ from the estimated inflation Proposal in the financial model.

In the above example, the private sector would price in 4% per annum (i.e. CPI + 1.5%) as a real price index assuming CPI is 2.5%. But what happens if this is actually 5% (i.e. CPI + 2.5%) or there is a major shortage of supply in the market for this service and there is an unexpected sharp real price increase? This increase may not be fully reflected in the CPI as the effect on the Project may be greater than its effect on the market as a whole. It is this Systematic Risk premium that should be adjusted for in the private sector Proposal.

______________________________________________________________________________________________

6 Source: Wages and Price table WP6, Access Economics December 2003 quarter.