8.3 Risk mitigation - relevance of insurance

When evaluating Retained Risk (for the purpose of constructing the PSC), specific consideration should be given to the ability of government to mitigate risks in practice. Risk mitigation is all about minimising and controlling either or both the consequences and the probability of a risk eventuating. Factors that may help mitigate Retained Risks include:

• ability to influence directly the probability of a risk eventuating;

• utilising proven technology and reputable contractors;

• developing effective monitoring and risk management practices; and

• maintaining appropriate insurance coverage.

Third-party insurance should be considered for economically insurable Retained Risks. Insurance coverage for commercial risks retained by Australian government agencies should be discussed with the relevant government insurer. Alternatively, government could self-insure. Self-insurance, which has been traditionally used by government, is the preferred approach where the cost of it is less than commercial insurance. Ideally, self-insurance should involve setting aside the premiums in a fund or dedicated reserve.

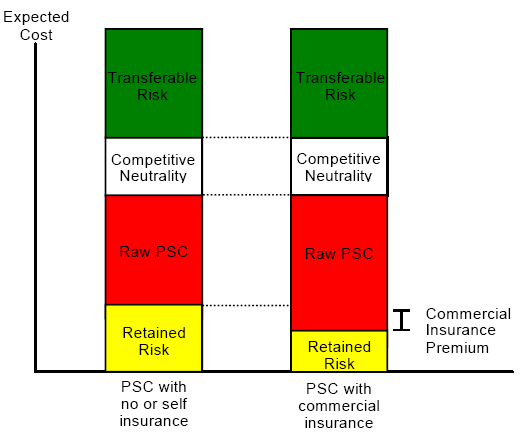

Where government uses commercial insurance (e.g. construction or contractor insurance), the cost of the insured risk to government is no longer included as a Retained Risk, since it has been passed at a cost to a third party. Instead, the cost of premiums should be included in the Raw PSC. Figure 8-3 illustrates the relevance of insurance in the valuation of Retained Risk.

Figure 8-3 Treatment of commercial insurance

The diagram also illustrates that not all Retained Risks are likely to be commercially insurable (e.g. change in law risk) - if they were, there would be no Retained Risk section in the second column in the diagram.

Alternatively, where no third-party insurance, or self-insurance is used, the cost should remain a Retained Risk, as the risk remains with government as a whole. However, the value of the Retained Risk may be estimated by calculating a notional insurance premium based on past losses or the applicable commercial premium for a similar insurable item.