Guidance notes - Identifying, allocating and evaluating risk |

For the PSC to provide a meaningful benchmark against which to compare private sector bids, it must include a comprehensive and realistic pricing of all quantifiable and material risks. However, it is also important to view the risk analysis required for the PSC as part of the broader process of identifying, allocating and managing project risks. |

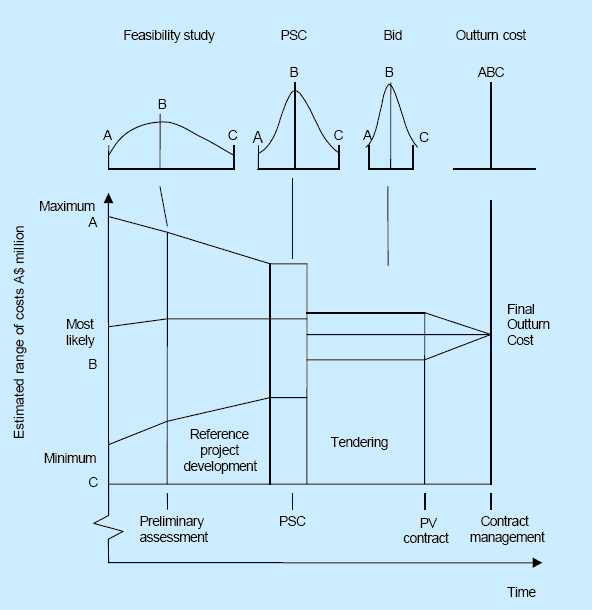

It is important to recognise that probabilities and uncertainties in cost prediction vary from stage to stage during the procurement process and therefore so do the measures of likely cost outcome and volatility. |

Figure 16-1: Torpedo diagram of risk analysis and management

|

This so-called 'Torpedo' diagram illustrates how the development of the reference project generally results in a better understanding of the risks associated with the project and a corresponding reduction in the spread of potential outcomes. The step-down between the PSC and the PPP contract represents the expected value-for- money outcome, albeit with some uncertainty associated with the Retained Risks. Final outturn cost will not be known until the end of the contract, but should lie within the range estimated when the contract was awarded. |

The Public Sector Comparator Guidance identifies two quantitative techniques for valuing risk: |

1. simple probability valuation techniques; and |

2. advanced probability valuation techniques based on probability analysis. |

A limitation of the simple probability technique is that it provides a single estimate for risk which is based on analysing risks independently of each other. The weighted effects of each risk are accumulated to provide the most likely outcome risk-adjusted PSC. |

Though more complex, the more reliable technique involves applying probabilities to the risks and considering interdependencies between the risks. Probability analysis overcomes the limitations of the simple approach by specifying a probability distribution for each risk, and then considering the effects of the risks in combination. The result of the analysis is a range of values in which the final outcome could lie. |

The expression of risk as a range of final outcomes is a far more useful tool for understanding government's exposure to risk volatility and demonstrating the robustness of risk transfer and management options. This information forms the foundation on which appropriate risk management strategies can be developed to mitigate and reduce government's risk exposure. |

Adopting this technique for the project may also assist in the bid evaluation process where bids are close to the PSC. Under such circumstances, a fuller appreciation of government's exposure to volatility may assist in ranking the bids and lead to making a sound business case for proceeding with a preferred bidder even where marginal, or no financial benefit can be demonstrated based on the mean case for the risk-adjusted PSC. Risk volatility can be analysed by considering and comparing the respective risk profiles for the PSC and the bids generated from the advanced probability valuation technique. These distributions are commonly represented as histogram plots, or cumulative frequency graphs and are typically generated by statistical software. |

For example, a PPP delivery mechanism may be preferred over the alternative PSC delivery, even if the private sector bid lies above the mean case, as the private party involvement would decrease government's exposure to downside volatility. Under such circumstances government obtains value-for-money (VFM) from a reduction in its exposure to the downside risk of cost increases exceeding those forecast. |

When to use the simple technique and when to use the advanced technique |

The Public Sector Comparator Guidance provides detailed guidance on determining the most appropriate risk valuation technique (see Section 6). It explains and provides examples of both these techniques. It also states that the technique adopted for a particular project, or a particular risk depends on the significance of the project and the complexity of the risks within it. Note that in the example, the advanced model includes more risks than the simple model for the same project. This is for illustrative purposes only. |

When selecting a risk valuation technique, factors to be considered include: |

• the relative impact of the risk on the project |

• the size of the project |

• the complexity of the project. |

For example, a relatively simple project, such as a hospital car park, is unlikely to warrant sophisticated advanced probability valuation techniques whereas a more complex project, such as a hospital, may warrant such analysis. But even this example may be over simplistic as a hospital car park project may be structured to transfer significant usage risk to the private sector and for this risk it may be advisable to carry out a probability analysis on the volume projections. |