16.3.2 Sensitivity analysis - advanced valuation technique

A limited sensitivity analysis has been undertaken for the project PSC on the main cos components of the risk-adjusted PSC so as to understand the effect that movement in these costs will have on the cost of the project. The results of this analysis are detailed in Table 16-6 below. Note that for the purposes of this exercise, the mean case has been used as the base case.

Table 16-6: Sensitivity analysis of the effect of movement of cost components on project cost-mean case basis

Movement in assumption | Capital cost | Operating cost | Discount rate | Inflation rate | Maintenance and refurbishment |

-15% | 427.4 | 451.1 | 478.6 | 466.5 | 455.8 |

-10% | 439.7 | 455.5 | 474.4 | 465.1 | 458.7 |

-5% | 452.1 | 460.0 | 467.5 | 464.6 | 461.5 |

Base case | 464.6 | 464.6 | 464.6 | 464.6 | 464.6 |

5% | 476.7 | 468.8 | 458.7 | 463.7 | 467.3 |

10% | 489.1 | 473.3 | 455.2 | 462.5 | 470.1 |

15% | 501.4 | 477.7 | 449.2 | 461.9 | 473.0 |

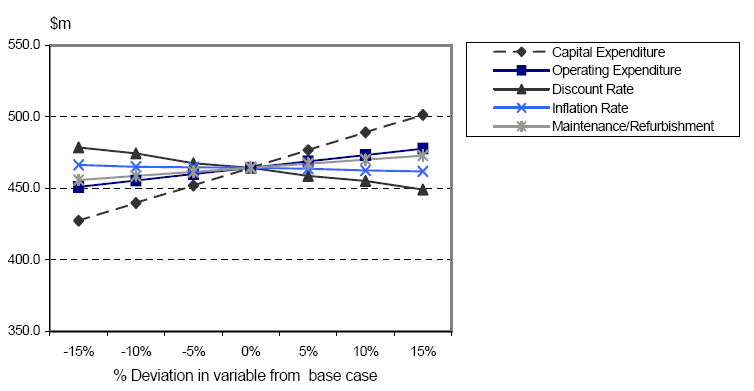

Figure 16-6 shows how a change in the key variables for the model (mentioned above) impacts on the total risk-adjusted PSC. Steeper gradients indicate that the NPC of the PSC is more sensitive to changes in this variable than to other variables tested.

Figure 16-6: Sensitivity chart - Impact of changes in variable on the total risk-adjusted PSC (mean case basis)

Note that the slight kink in the graph is primarily is due to the simulation effects of running @Risk when using the advanced valuation technique for each change in the discount rate and inflation rate. The overall trend of the graph should be reviewed rather than individual movements.

This analysis indicates the following:

(i) Project capital costs

Every 5 per cent change in the capital cost of the project produces a change of approximately $12 million in the total project cost. Figure 16-6 shows a steeper gradient for this cost compared to the other variables being tested. This means that the total PSC is more sensitive to changes in this variable than to changes in the other variables. This result corresponds with the significant proportion of the total PSC which relates to capital costs, i.e. 51 per cent.

(ii) Project operating costs

Figure 16-6 shows that the PSC is less sensitive to changes in project operating costs than changes to the project capital costs, illustrated by the flatter gradient. Every 5 per cent change in the base operating cost produces $4 million change approximately in the total PSC.

(iii) Discount rate

Figure 16-6 clearly illustrates the inverse relationship between the discount rate and the NPC of the project, i.e. the larger the discount rate the lower the NPC. The flatter gradient of this line indicates that the total PSC is not as sensitive to this variable as it is to the project capital costs.

(iv) Inflation rate

The flat gradient shows that a 5 per cent change in the inflation rate has minimal effect on the overall PSC, which suggests that the PSC is not sensitive to changes in this variable.

An increase/decrease of 5 per cent in this cost produces a corresponding increase/decrease of nearly $3 million on the total PSC, but as can be seen on the graph, the gradient of this cost is flatter than for the other variables tested, except for inflation. This suggests that the PSC is less sensitive to maintenance and refurbishment costs relative to the other costs tested, except for inflation.

In summary, the project PSC is more sensitive to movements in the project's capital cost, compared with other variables. These results should be reviewed with some caution because each variable is analysed separately. However, in reality these costs are often dependent on each other.